is a car an asset for fafsa

An asset is property that the family owns and has an exchange value. Best Car Loans Personal Loan Calculator Personal Loans 101 Paying Off Student Loans Banking.

Fafsa Tips 7 Ways To Get More Financial Aid Money

The FAFSA will ask you for your own identifying details as well as marital status.

. The short answer is yes generally your car is an asset. With EFC lower is better. 529 Plan and FAFSA.

The FAFSA also asks about untaxed income which means that withdrawing from a Roth IRA to pay for college expenses could also reduce your childs financial aid package said Mark Kantrowitz the. Small businesses If your family owns a small business you wont need to report it on the FAFSA. The FAFSA4caster tool available online through the US.

Retirement savings dont have to be reported as an asset on the Free Application for Federal Student Aid butand this is a big but in your caseonly if the money is in a qualified account. The FAFSA for the 2022-23 academic year opened on Oct. The FAFSA will prompt you to enter general information for your child as well as their dependency status and the schools theyre considering to direct where their FAFSA information should be shared.

The FAFSA for the 2022-23 academic year opened on Oct. Your car is a depreciating asset. However 529 plans that are owned by grandparents are not counted as an asset when a student completes the FAFSA but some colleges do ask for.

Ethos sells term and whole life insurance online and most people who qualify dont have to take a medical exam. An asset is property that the family owns and has an exchange value. Your car loses value the moment you drive it off the lot and continues to lose value as time goes on.

The Free Application for Federal Student Aid form is used to determine how much a student and his or her family are eligible to receive in federal financial aid. You cant leave an asset off the aid application simply because you intend it. Best Car Insurance Companies.

If the student is an orphan both parents dead in foster care or a ward of the court at any time after reaching 13 years of age or older the student is considered independent even if the student is subsequently adopted. More than 44 million college students recieved some sort of college diploma in 2021 from associates to doctorate or professional degrees but whatever else that can be said about the Class of 21 we know this. The FAFSA opening date and FAFSA deadline is the same for everyone.

You can stop including your parents income on your Free Application for Federal Student Aid FAFSA when you are eligible to apply for federal aid as an independent student. Department of Education can be used to estimate how much federal aid youre eligible to receive. Lets say you crash your car.

Being 24 years old at the time you fill out your FAFSA or being in the process of earning a graduate degree automatically qualifies you for independent student status. Nearly 70 soon will have to confront the reality of student loan debt. One of the most common mistakes on the FAFSA is to report retirement plans and net home equity as investments.

Most are awarded based on your financial need and determined by the income you reported on. The FAFSA form collects current data as of the day of signing the FAFSA form about cash savings and checking accounts investments businesses and investment farms. Its fraud not to do so.

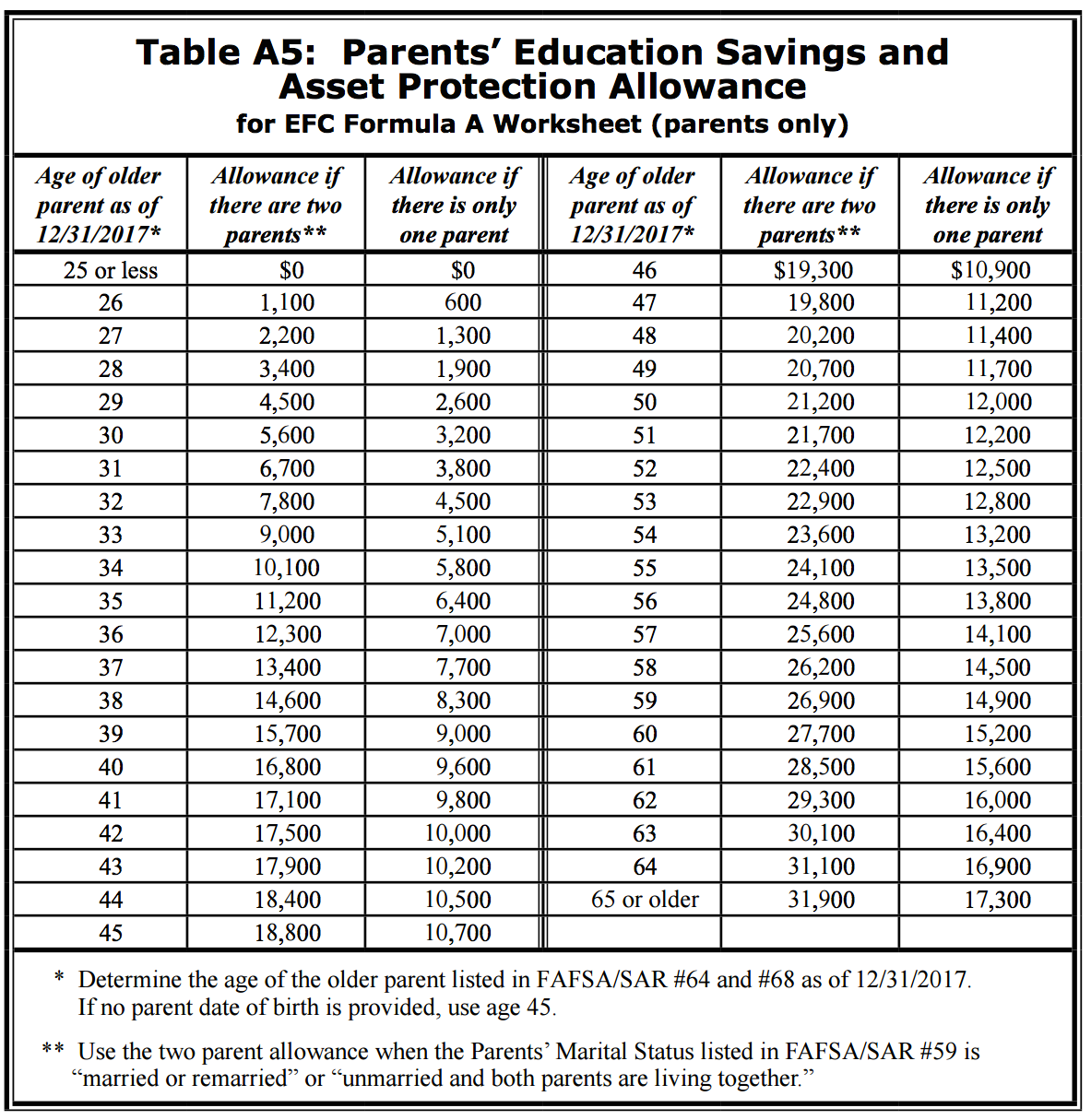

Provide your parent demographics and financial details. For example the asset protection allowance for a parent age 65 or older was 84000 in 2009-10 but falls to 29600 in 2016-17. You MUST put this down on your FAFSA.

Unfortunately the asset protection allowance has been declining since 2009-10 and will drop even further with the 2016-2017 FAFSA. The only way to NOT declare this money is to spend it. These are non-reportable assets.

If you have a large auto loan consider taking money out of a reportable asset to help pay it off. Small businesses are defined as businesses with under 100 full-time employees. Using a Financial Advisor Retirement Planning 401k Plans IRAs Stocks Best Investment Apps Taxes.

The FAFSA may also be used to determine a students eligibility for state and school-based aid and also may influence how much private aid a student receives. Other investments are reported on the FAFSA application including bank accounts brokerage accounts and investment real estate other than the primary home. Filing Taxes Best Tax Software Filing a Tax.

The impact of an asset depends on whether it is a student asset or a parent asset. The car also isnt reported as an asset on the FAFSA. If the student is considered independent parental information is not required on the FAFSA.

Colleges states and the federal government give out grants which dont need to be repaid. But its a different type of asset than other assets. EFC is an index score that is used to determine a level of financial need.

Student assets increase the EFC by 20 of the asset value on the FAFSA and 25 on the CSS Profile Parent assets are assessed on a bracketed scale increasing the EFC by up to 564 on the FAFSA and up to 5 on the CSS Profile. Learn if Ethos is right for you. Jen is an incredibly valuable asset to my School Counseling program at Audubon High School Walter said.

The FAFSA collects current data as of the day of signing the FAFSA about cash savings and checking accounts investments businesses and investment farms. The more income and assets the student and parents have obviously the less aid the student will be eligible for. This can reduce your total reportable assets.

Gap insurance guaranteed auto protection insurance is something car dealers and lenders sell you to cover the gap between what an insurance company thinks your car is worth and what you owe on your car loan in the event youre in an accident and the insurer declares the car a total loss. If you simply remove it from your account but still have the cash you must still declare it as an asset as CASH is an asset. Best Banks Understanding Interest Rates Saving Accounts Checking Accounts CD Rates Credit Unions Investing.

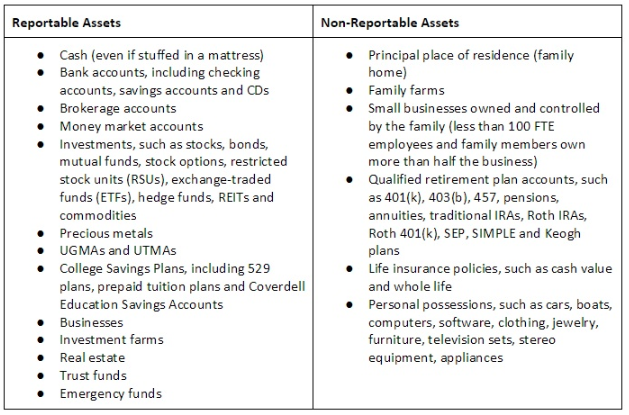

Reportable and non-reportable assets are illustrated in this table. Income is placed into the. In a rural area we have the same access to support and resources for our students as other areas of the state and Jen is a big part of making that happen.

Shifting an asset from a reportable category to a non-reportable category can help shelter the asset on the FAFSA.

2017 Guide To College Financial Aid The Fafsa And Css Profile

Css Profile Vs Fafsa How Are They Different Nerdwallet

How Assets Can Hurt Your Student S Financial Aid Package Collegiateparent

Fafsa Tips How To Shelter Your Savings And Get More College Aid Money

What Counts As An Asset On The Fafsa College Raptor

Leasing A Car Is A Bad Financial Move For College Students

The Fafsa View On Parent Vs Student Assets

Do My Savings Affect Financial Aid Eligibility Money

How Do You Apply For The Fafsa 10 Simple Steps

What Is The Expected Family Contribution Efc For Financial Aid Eligibility Bautis Financial

How To Shelter Assets On The Fafsa

Just How Risky Is It To Lie On Your Fafsa Application College Finance

The Fafsa Asset Protection Allowance Plunges To Near Zero

Is My Car An Asset Or A Liability

Which Assets And Debts Are Reported On The Fafsa Fastweb

Fafsa Understanding Parent And Student Assets Lendkey